Whether you’re planning to build an inground pool or an above-ground pool, you need to consider your homeowners insurance. Pools are considered an ‘attractive nuisance’ in the US and will therefore affect your homeowners insurance and liability coverage.

Dive into this month’s article to find out more. We’ll explain how owning a pool affects homeowners insurance and liability coverage, plus the precautions you must take to ensure your pool is suitable for coverage.

Don’t forget, there are various health benefits of having a pool, and here at Aqua Blue Pools, we can bring your dream pool to life!

Give us a call on [ld_default] to speak with our team and discuss your dream pool!

Does having a pool raise your homeowners insurance?

Whether or not a pool will increase your homeowners insurance premiums will depend on your current policy. Most homeowners insurance policies in the US will include coverage for a pool, but you will be required to take a few precautions to mitigate the risk of harm. This may include:

- Installing a fence around the perimeter of the pool

- Installing a safety cover on the pool

- Posting a sign warning of the dangers

- Providing accessible safety equipment

Some insurers will increase your premiums by $50 a year to cover inground pools. In any case, we highly recommend contacting your insurer before you install your new pool to establish exactly what your current policy covers and your options for improved coverage.

Does homeowners insurance cover damage to your pool?

Homeowners insurance usually covers damage to the pool, but again this may not be in every case. Some companies will consider the pool to be part of the home, whereas others may consider it to be an external structure that is detached from the home and not personal property. In the latter case, the pool will need to be declared before it is covered. External structures are usually only covered by 10% of the replacement cost of the home, so you may need to increase your coverage if your pool exceeds this value.

Does my pool impact liability coverage?

Liability coverage is the element of your homeowners insurance that covers medical bills or lawsuits that result from an incident sustained in or around your pool.

Most homeowner insurance policies include up to $100,000 of liability insurance for pools. This may seem sufficient, but most pool owners are advised to increase their coverage to $500,000 by either paying higher premiums or taking a separate umbrella policy. The increased coverage typically costs $50-$75 but may be lower in warmer areas where homes are expected to have pools.

What are the requirements for pool insurance?

Speak with your insurer directly to find out the specific requirements needed for coverage. Almost every insurer will provide coverage if your pool meets their safety requirements. Typically, these requirements say:

- It must not have diving boards or slides

- It must have a minimum four-foot fence around the perimeter of the pool or the backyard

- The pool must never be empty but always filled with water.

What is the average rate for homeowners insurance with a pool?

The total cost of your homeowners insurance premiums will depend on a number of factors, including where you live and where the pool is located in relation to the house. It also depends on the level of coverage you have purchased, as well as the type of pool you have built. Typically, you will be expected to pay more to cover an inground swimming pool.

To find out how much your homeowners insurance will rise after building a pool, contact your insurer. Before you phone, you should establish the type of pool you are building, its location and whether you intend to purchase extended liability coverage.

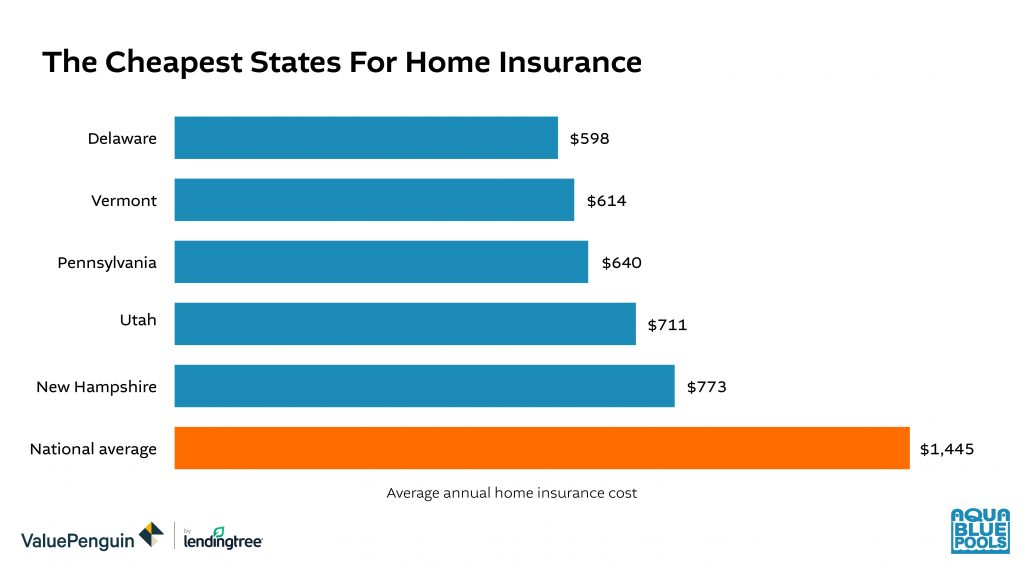

What are the cheapest states for Home Insurance?

According to information taken from ValuePenguin by lending tree, the cheapest state for Home Insurance (2021) is Delaware DE, at $598. Far behind the national US average of $1,445.

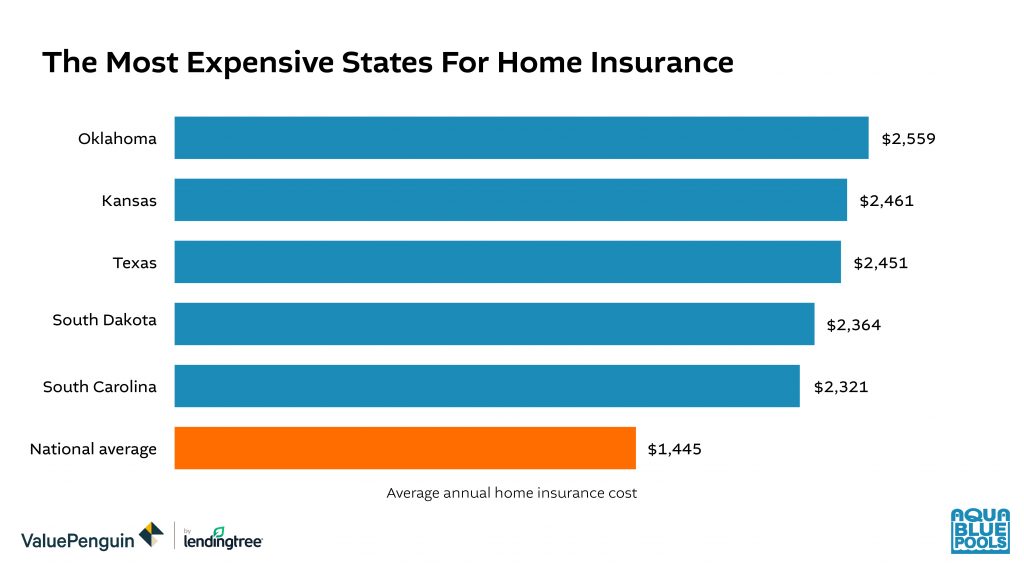

What are the most expensive states for Home Insurance?

According to information taken from ValuePenguin by lending tree, the most expensive state for Home Insurance (2021) is Oklahoma OK, at $2,559. A good $1,100 above the national US average of $1,445.

Planning is key to ensuring you build a stunning backyard pool that is attractive, safe and insured. As leading pool builders for South Carolina SC, we provide our expertise throughout the entire process. We will help with the planning, design, construction and maintenance, so that you can enjoy your pool all year round.

Take your first step to owning your dream pool. Contact the Aqua Blue Pools team today.